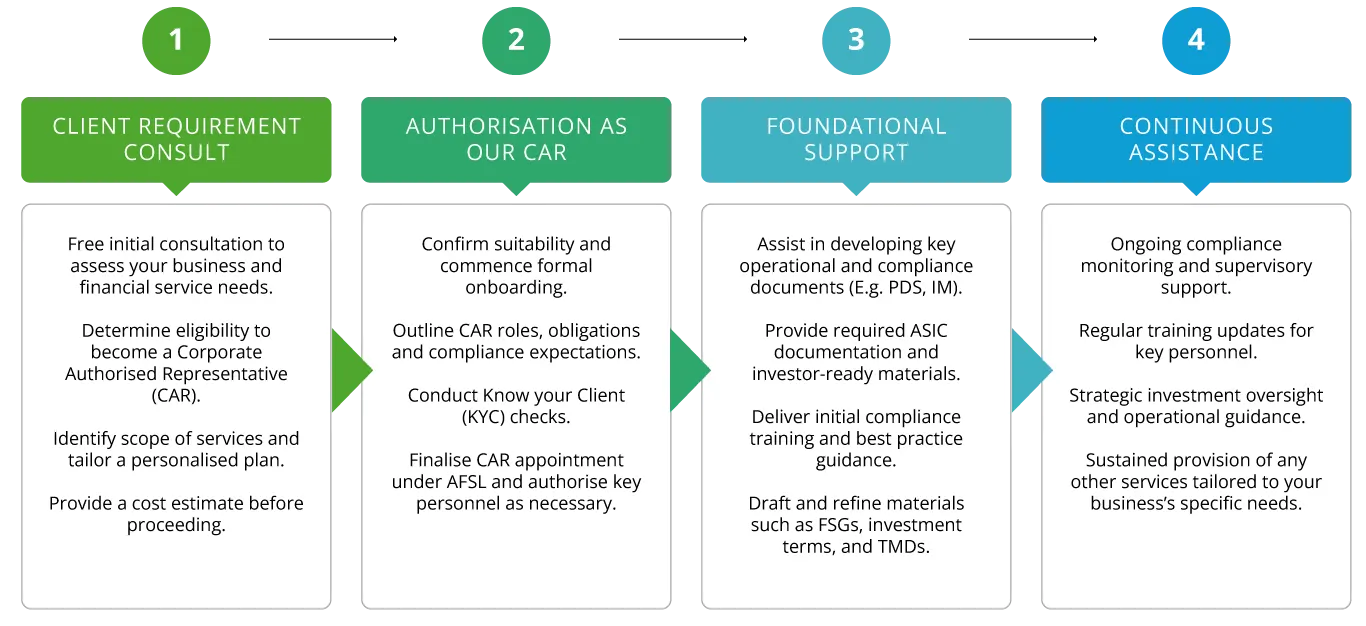

1. Client Requirements Consultation

The initial phase of the CAR onboarding process is designed to recognise and understand your specific business needs. This includes a free consultation where your AFS requirements are reviewed so we can develop a personalised client plan moving forward. The consultation covers your business’s financial service needs as well as your eligibility to act as an authorised representative under our licence. Once these requirements are outlined, the costs will be confirmed before the second phase commences.

2. Authorisation as Corporate Authorised Representative (CAR) of Australis

Once suitability has been determined, the process of authorising your company as an Authorised Representative will commence. This involves outlining the responsibilities and capabilities included when acting as a CAR, as well as a Know Your Client (KYC) review in the form of a National Criminal History & Bankruptcy check. Other verification documents will also be requested, including:

- A current CV

- A verified passport

- Confirmation of qualifications (in relation to CV)

Other client documents may also be requested as seen fit by Australis. Once this KYC review has been completed, your status as an authorised representative under our AFSL can be processed and finalised.

Other procedures may also be conducted as a formality, including the authorisation of additional staff members where relevant.

3. Product Choice and Development

Once the CAR authorisation agreement is approved and all relevant checks have been completed, it's time to begin building the foundational elements of your product. At Australis, we will assist the development and subsequent growth of your business via aiding the formation and release of ASIC required and promotional documents such as your Investment Memorandum (IM) or Product Disclosure Statement (PDS). Furthermore, all relevant training and compliance requirements will be provided to ensure your company meets both ASIC’s legal regulations but also best practice industry procedures.

As part of this process, Australis also assists with the drafting and refinement of key operational documents that support your fund’s compliance and investor communications. This includes foundational materials such as financial service guides, investment terms, and any required target market statements.

4. Continuous Assistance

Once your chosen product has been established, Australis remains committed to providing your firm with ongoing compliance support, updated training programs, strategic investment guidance, and supervisory oversight where required or requested.